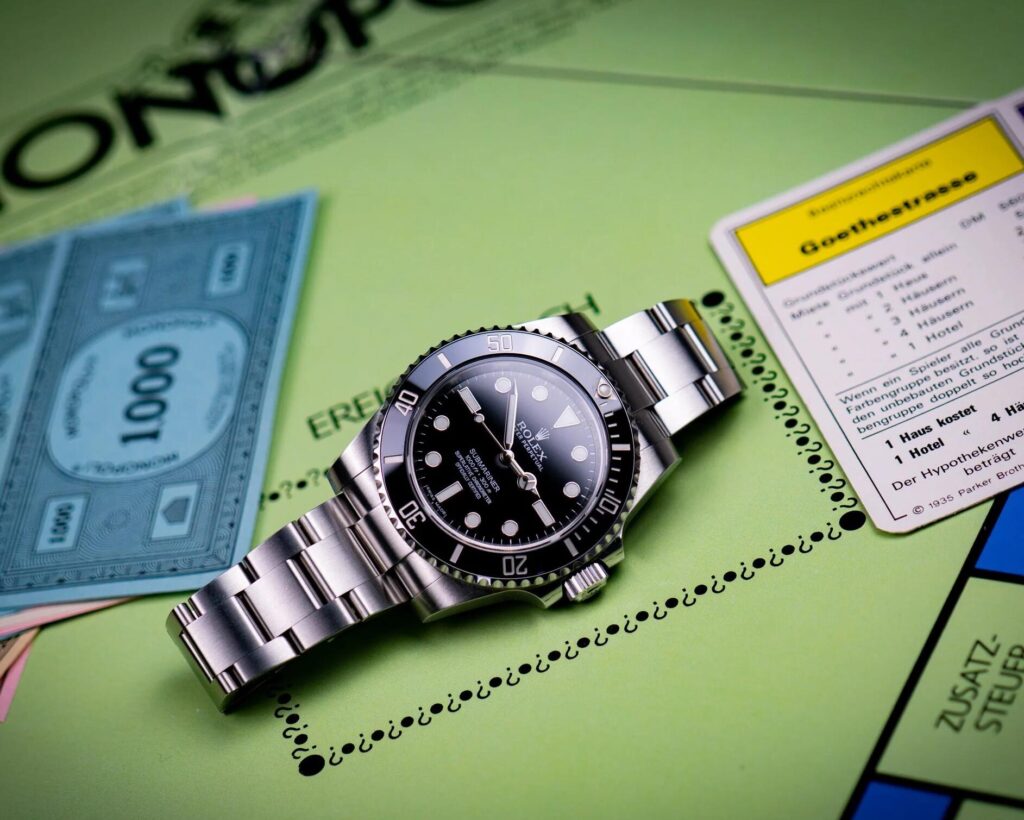

Replica Rolex as an investment: Does the bubble bang!?

Replica Rolex crisis in Munich! Hysterical scenes before Christmas! – this is how the editorial team of the tabloid Abendzeitung once described the situation in Munich’s shopping malls to point out the empty displays of the Rolex concessionaires. One gets the impression that in the metropolis with the second highest concentration of income millionaires in Germany, panic buying is taking place and Rolex watches are being stashed away like toilet paper in the Corona crisis. Despite the sensational headline in the evening newspaper, it must be noted that the Rolex bubble has actually expanded significantly in the last two years: In times when banks are threatening negative interest rates, many apparently see Rolex watches as an attractive investment or an investment that promises a hefty return . The gray market prices for Rolex are exorbitantly high – buying a Rolex is essentially a no-brainer. Or?

Buying a Rolex as an investment – a no-brainer?

Well, some time ago I looked very critically at the topic of watches as an investment in general. My conclusion back then, supported by a few calculation examples: Watches are fundamentally by no means as simple or safe an investment as many online shops would like to convey to their potential customers in “editorial” articles (“Invest in James Bond’s favorite watch!” etc.).

At Rolex, however, the situation has gotten massively worse: at the beginning of 2024, I was able to pick up the popular Rolex Submariner directly from a jeweler without waiting. Hard to imagine today: the situation at Rolex has now become so dire that the Submariner NoDate, for example, with a list price of around €7,000, can hardly be had for less than €11,000, even as a used watch. Would you like more examples?

Rolex responded to the rocketing demand with a price increase in 2024 – after all, Rolex is adding an average of almost 7% to the list prices. Popular models such as the Submariner and Daytona are particularly affected. Slightly less popular models such as the Explorer I were only increased moderately.

Rolex as an investment: Does the bubble bang!?

But back to Rolex as an investment. Maybe it’s just a bubble that’s about to go bang? Will prices return to normal levels? Will there even be a sharp drop in prices? Will you ever be able to get the Rolex Daytona again at the list price with humane waiting times at the jeweler? Well, I personally find all of this to be extremely unlikely – the demand is still unbroken and far too extreme for these cases to realistically occur.